Our business loans are designed for one thing, your business needs

Aasaan Loans is powered by Akme Fintrade India Limited (AFIL). AIFL has a legacy of 25 years in traditional lending services, with presence in Rajasthan, Maharashtra, Madhya Pradesh, Gujarat – 20 physical branches 4 states with 24 points of presence having served over 200,000 customers till date.

Aasaan Loans believes in assisting small businesses in growing by providing loans to those with potential and intent. Many such businesses have little or no access to capital from traditional banks and other financial institutions, or they lack either collateral or a financial data trail to obtain loans.

CALL US NOW

EMAIL US

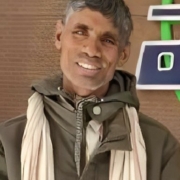

I am thankful to Akme Fintrade for fulfilling my dream to own a bike for an easy commute. Akme Fintrade helped me with the quick loan process. I liked the company and I am happy with the great services.

Copyright © 2023 Aasaan Loans.